Bitcoin (BTC) is back on the road to success as it continues to surpass the $ 55,000 mark, a scenario that last occurred in May. According to CoinMarketCap, the leading cryptocurrency is up 2.48% in the past 24 hours to hit $ 55,607 during intraday trading.

This price hike is partly triggered by the scarcity in the BTC market. On-chain analyst Will Clemente stated:

“An estimated 38.2% of the BTC supply is lost. 92% of the offer has not moved for at least 30 days. 85% of the offer has not been moved for at least 90 days. The scarcity of Bitcoin cannot be overestimated. “

Hence, the illiquid or immovable supply of Bitcoin has skyrocketed and, based on market forces, the price is expected to increase as supply decreases and demand increases.

Clemente acknowledged that the estimate of lost or immovable coins is done by subtracting the vibrancy (ratio of created / destroyed coin days) from 1 and multiplying that value by the circulating supply.

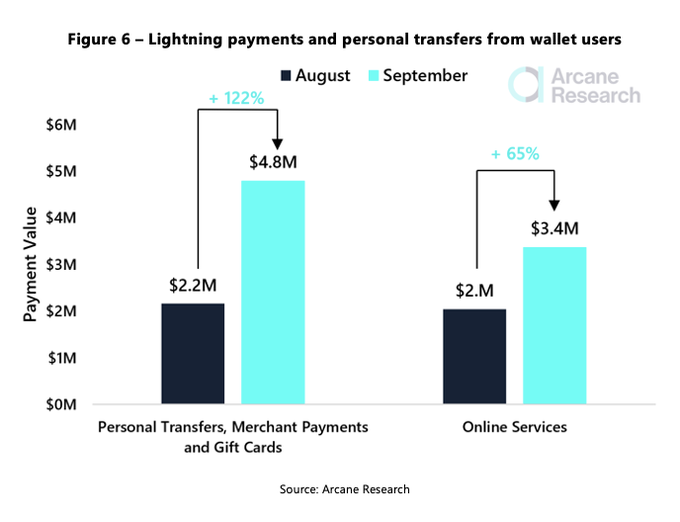

Online services are driving the use of the BTC Lightning network

According to the cryptanalysis company Arcane Research:

“The use of Lightning is shifting from the dominance of online services to everyday use. The step from users with access to Lightning Payments to actual Lightning usage is not the same. Nonetheless, spending on frequently used wallets doubled in September. “

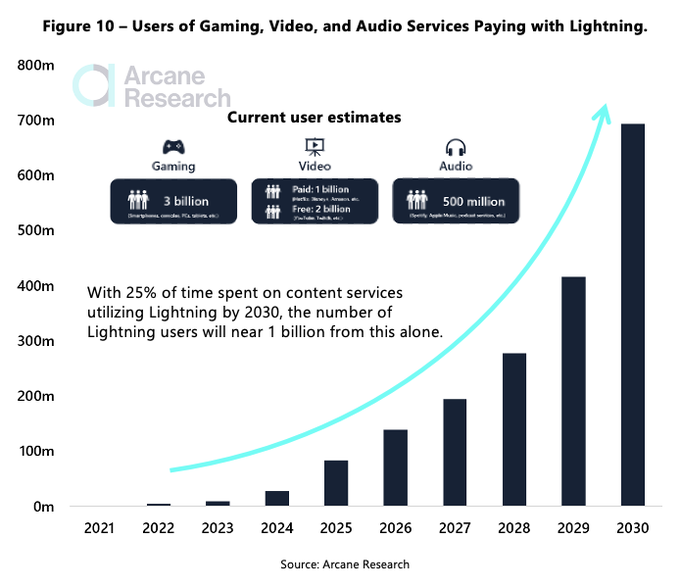

Arcane Research acknowledged that the Lightning Network could radically transform the business model of content providers in games, video, audio, and many other categories by providing a structure in which continuous micropayments are made.

The capacity of the Bitcoin Lightning Network recently exceeded 3,000 BTC for the first time.

This network is a second layer that is integrated into the Bitcoin blockchain to perform off-chain transactions. As a result, micropayment channels are being used to scale the capacity of the blockchain to make transactions more efficient.

Hence, it is believed that transactions in lightning networks are easier to confirm, cheaper and faster than those processed in the chain or in the Bitcoin mainnet.

Image source: Shutterstock