Elizabeth Warren, the Democratic Senator from Massachusetts, recently launched a political campaign against cryptocurrencies as she seeks a third term in office in 2024. In a recent “Meet the Press Reports” interview with NBC’s Chuck Todd, Warren likened buying Bitcoin to “buying air.” Despite her stated distrust of banks, Warren told the show’s host that when it came to the digital currency Central Bank (CBDC) thinks that “it is about time we moved in this direction”.

Warren likens buying bitcoin to “buying air” and says it’s time to move towards CBDC

Democratic Senator from Massachusetts Elizabeth Warren has been vocal about her skepticism about cryptocurrencies like Bitcoin (BTC), citing risks and negative environmental impacts associated with Bitcoin mining. Additionally, Warren recently attributed the liquidation of Silvergate Bank to a “crypto risk.” During a recent interview with Chuck Todd on Meet the Press Reports, Warren reiterated her dislike for Bitcoin. “If I buy bitcoin, what am I buying? Are you buying air?” Senator Warren asked. “With bitcoin, there is no underlying asset that backs it, it’s just a matter of belief,” she told Chuck Todd during the interview. When Todd asked if Bitcoin could be likened to a painting, she dismissed the comparison, stating that with a painting she could physically own it and throw darts at it. “Instead of bitcoin, we should be discussing digital currencies,” Warren suggested, noting that digital currencies are different from bitcoin because they are government-backed.  Warren has been a vocal opponent of the Federal Reserve’s recent rate hikes. During her interview with Todd, she expressed her belief that while banks aren’t perfect, it’s about time the government transitioned to a central bank digital currency (CBDC).

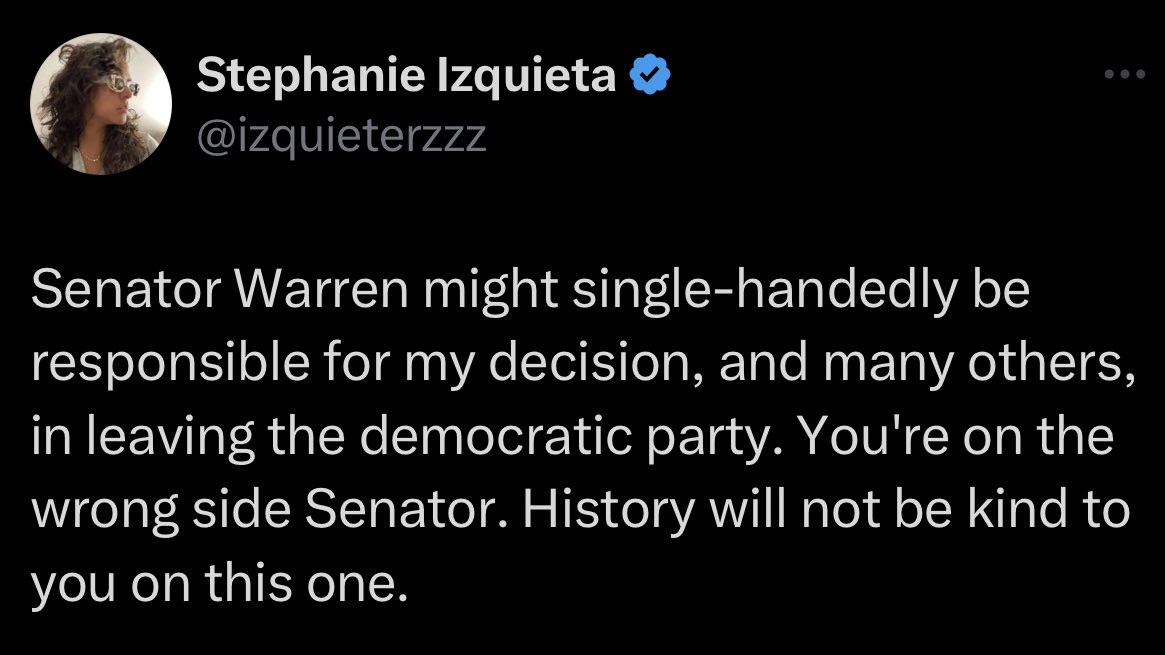

Warren has been a vocal opponent of the Federal Reserve’s recent rate hikes. During her interview with Todd, she expressed her belief that while banks aren’t perfect, it’s about time the government transitioned to a central bank digital currency (CBDC).  The Massachusetts politician also drew comparisons between the digital world and the real estate crash of 2008. “How many times have people said, ‘Real estate always goes up. It never goes down? You said it decades ago, before the last real estate bubble. They said it in the 2000s, before the 2008 crash,” Warren said. Ultimately, Warren believes that the crypto industry will be subject to strict regulation. Despite Senator Warren’s anti-cryptocurrency stance, a number of Democrats have taken to social media to express dissatisfaction with their position.

The Massachusetts politician also drew comparisons between the digital world and the real estate crash of 2008. “How many times have people said, ‘Real estate always goes up. It never goes down? You said it decades ago, before the last real estate bubble. They said it in the 2000s, before the 2008 crash,” Warren said. Ultimately, Warren believes that the crypto industry will be subject to strict regulation. Despite Senator Warren’s anti-cryptocurrency stance, a number of Democrats have taken to social media to express dissatisfaction with their position.

tags in this story

Anti-Crypto Army, Backlash, Big Banks, Bitcoin, CBDC, Chuck Todd, Controversy, Corruption, Crypto Assets, Cryptocurrency, Debate, Democratic Party, Democrats, Digital Currency, Elizabeth Warren, Environmental Impact, Federal Reserve, Government, Rate Hikes, Massachusetts , Meet the Press Reports, Political Campaign, Banking Bias, Public Opinion, Regulation, Senator, Silvergate Bank, Skepticism, Social Media, Third Term, Tyranny

Much of the reaction to her recent tweet about building an “anti-crypto army” has been negative, with individuals expressing disappointment with Warren’s views. “Pro-tyranny army – I don’t think we should be surprised as you personally have benefited from the current corrupt system,” one person told the senator. “The big banks really own you, don’t they? It only lasted two terms in the Senate. I wish you would start fighting for the people again instead of the banks,” another person tweeted at Warren. What do you think of Senator Warren’s stance against cryptocurrencies and her call for a central bank digital currency? Do you agree or disagree with their views? Share your thoughts in the comments below.

![]()

Jamie Redman

Jamie Redman is the news director at Bitcoin.com News and a Florida-based financial technology journalist. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for bitcoin, open source code and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about today’s emerging disruptive protocols.

Photo credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer, or a solicitation of an offer to buy or sell, or a recommendation or endorsement of any product, service, or company. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.